Distribution of financial contribution across Czech regions in the H2020 and HE programmes

11/20/2025 Author: Daniel Frank

Financial contruibution from the EU Framework Programmes (FP) remains strongly concentrated in a few regions of the Czech Republic. In Horizon Europe (HE), Prague’s share in total funding for the Czech Republic has decreased slightly, from around 55.1% to 51.4%. However, the overall unevenness in the distribution of funds has changed only marginally (the decline in the Gini coefficient is minimal) and the metropolitan axis Prague–South Moravian Region (Jihomoravský) – Central Bohemian Region (Středočeský) continues to dominate. In addition, the Central Bohemian Region is closely intertwined with Prague, so that most support is in effect concentrated in two major centres.

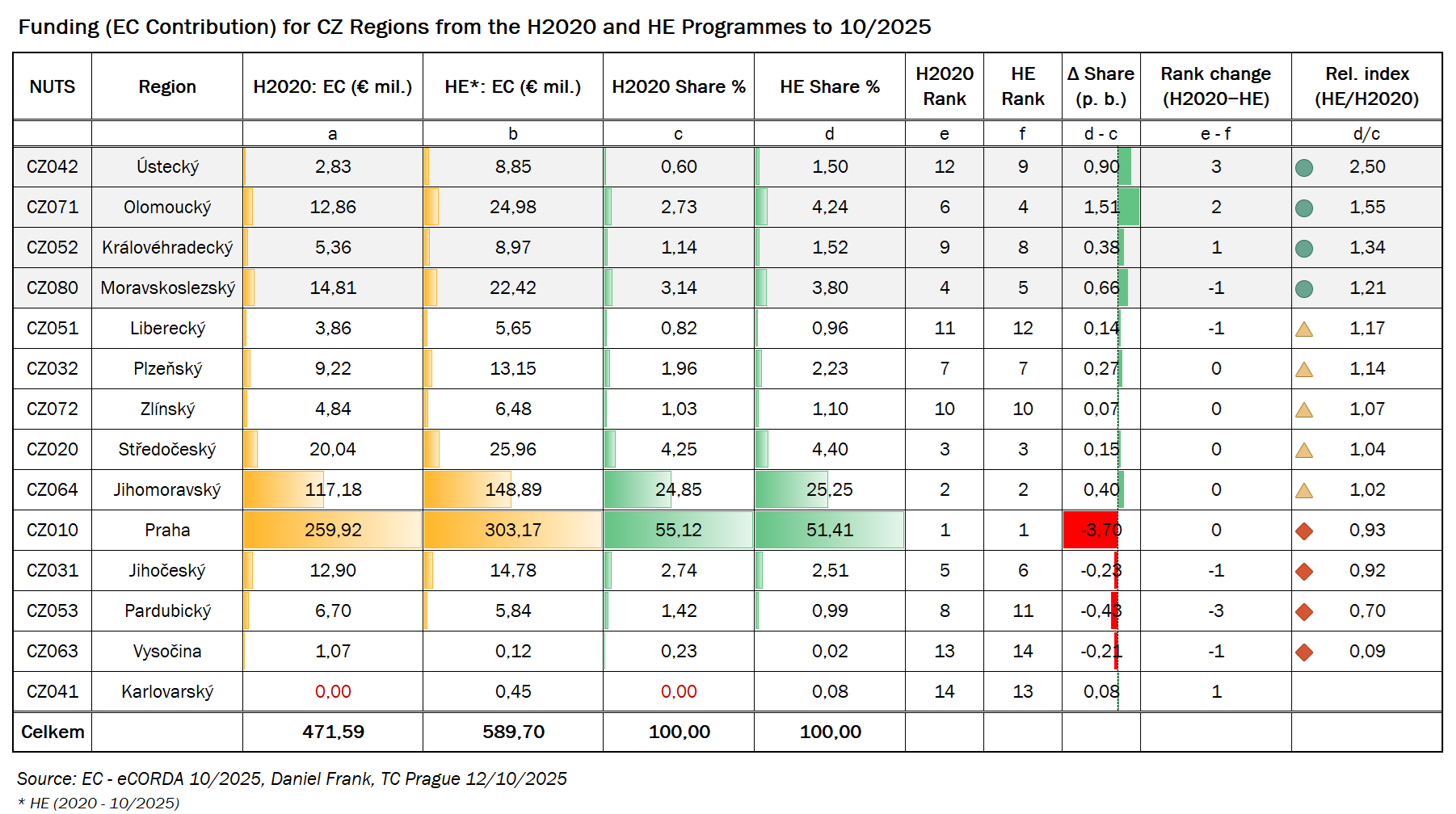

Table 1: Distribution of financial contribution across Czech regions in H2020 and HE

The largest relative increase in funding share was recorded by the Ústí Region. In HE, its share of the support allocated to the Czech Republic rose by about 0.90 percentage points compared with H2020. The magnitude of this jump is illustrated by the relative index, i.e. the ratio of the region’s share in HE to its share in H2020. A value of 2.50 for the Ústí Region means that its share in HE is two and a half times higher than in H2020. The improvement is also visible in the ranking of Czech regions: the Ústí Region moved up from 12th to 9th place.

Immediately behind Ústí is the Olomouc Region, which improved significantly: its share increased by roughly 1.51 percentage points, it moved up the ranking from 6th to 4th place and a relative index of 1.55 shows that its share in HE is about one half higher than in H2020. The third largest relative increase was achieved by the Hradec Králové Region: its share in HE rose by 0.38 percentage points, it moved from 9th to 8th place, and a relative index of 1.34 means that its share is roughly one third higher than in H2020. The Moravian-Silesian Region also strengthened, by 0.66 percentage points; its relative index of 1.21 indicates an increase of about one fifth compared with H2020. In the regional ranking, however, it fell slightly (from 4th to 5th place), because several other regions – especially Olomouc and Ústí – grew even faster.

Among the “moderately growing” regions, the Plzeň and Liberec Regions are worth mentioning: in HE they improved somewhat compared with H2020, but without any dramatic change in position, while the Zlín Region has essentially maintained its standing. The South Bohemian Region weakened slightly and dropped by one place; the Pardubice Region declined more markedly and fell by several positions.

The Vysočina and Karlovy Vary Regions remain on the long-term periphery of international research in the Czech Republic.

In regions with a low initial volume of support, just a few large projects can strongly influence both their overall share and their position in the ranking. It is therefore important to consider carefully whether an apparent increase reflects a one-off effect and the work of a few strong teams and agile individuals, or a broader and more lasting transformation of the regional ecosystem (more active organisations, a stable pipeline of project proposals). The first scenario is more likely in the Ústí Region, the second in the Olomouc Region.

A closer look at the participation of these two regions in the FP clearly shows the difference. In H2020, the Ústí Region relied mainly on “classical” energy and networks (ČEZ Distribuce, ORLEN UNICRE/Unipetrol), with only a few contributions from the academic and public sectors. In HE, the volume of funding increased rapidly, but it is concentrated in a few key projects and actors: in particular two large “hydrogen” projects involving Chart Ferox (sHYpS, GOLIAT), complemented by projects with the participation of UJEP (SpongeBoost, INERRANT, METAMORPHOSIS, STREP, LAND4CLIMATE) and the involvement of regional municipalities (Krásná Lípa, Administration of the Bohemian Switzerland National Park). Most local actors still play the role of partners and the thematic focus remains relatively narrow. The overall increase in the region’s share therefore looks more like a jump driven by several strong projects and teams than a broad, systemic change in the regional ecosystem.

By contrast, the Olomouc Region exhibits a different type of shift: rather than a one-off “jump”, it reflects a long-term expansion of capacities and roles. Building on the foundations established in H2020 (a strong Palacký University (UPOL) across disciplines), the region has in HE expanded into a wider range of topics and instruments and has taken on coordination roles more frequently. A key role is played by CATRIN (formerly RCPTM), which accounts for a substantial part of income from top-level schemes (e.g. ERC, EIC) and at the same time leads several MSCA lines (especially PF/SE, and in some cases DN). Projects in materials/2D and battery research are mainly carried by UPOL/CAtrin, biomedical topics are handled by UPOL teams together with the University Hospital Olomouc, and rail mobility has long been covered by OLTIS GROUP (Europe’s Rail). The result is a doubling of volume compared with H2020, more coordinations, a broader thematic portfolio and a visibly more systematic pipeline of project proposals – growth that appears structural and is likely to be sustainable in the longer term.

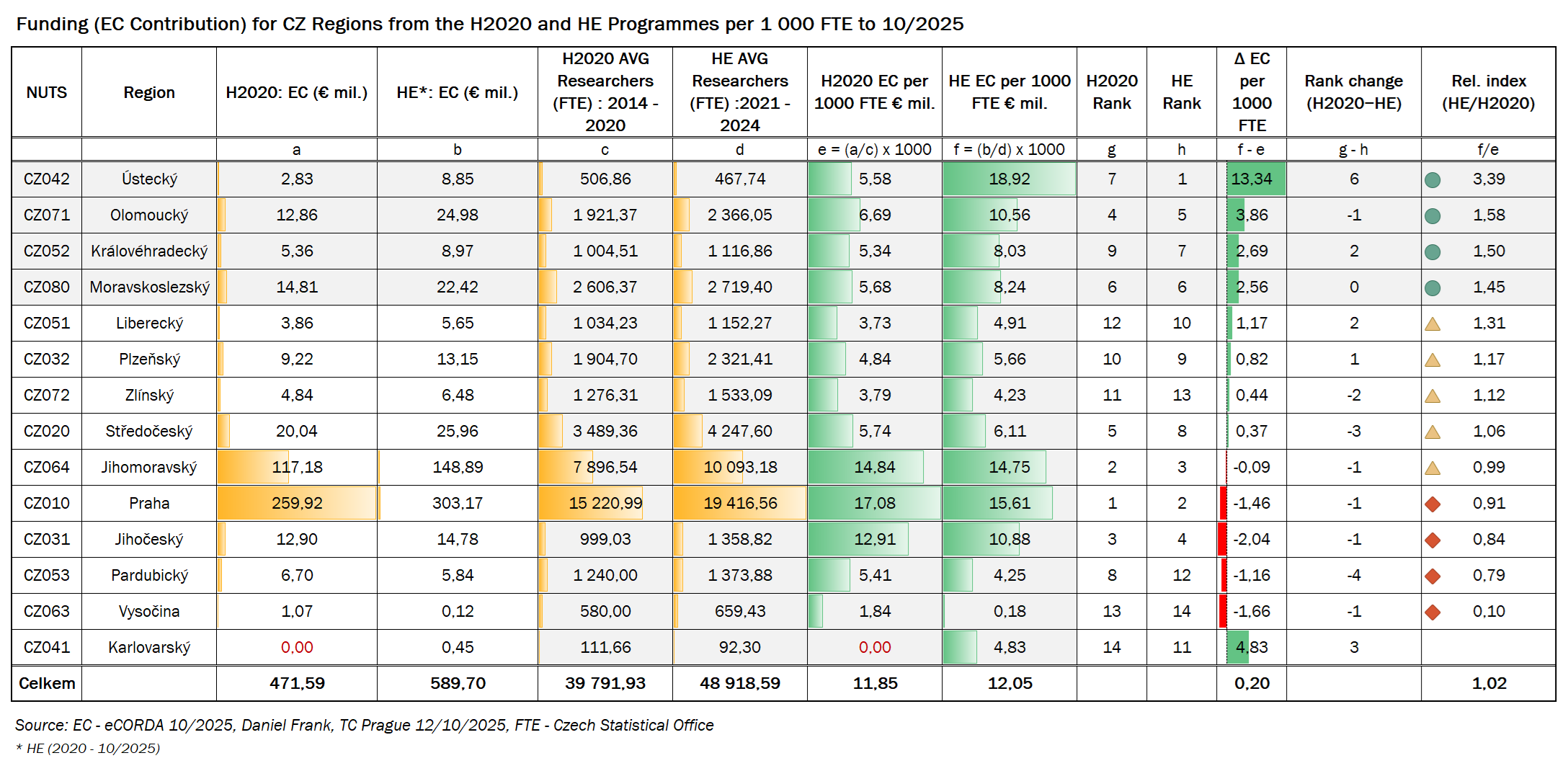

When financial contribution is recalculated per 1,000 FTE researchers (Table 2), the overall picture of the regions does not fundamentally change, but differences in the intensity of support become more pronounced. The Ústí Region moves to first place with 18.92 million € per 1,000 FTE, and a relative index of 3.39 confirms an exceptional leap relative to the size of its research base. Above-average intensity of support is also recorded in the Olomouc, Moravian-Silesian and Hradec Králové Regions, which improve both in absolute terms and after adjustment for FTE. The Karlovy Vary Region moves from zero values in H2020 to the middle of the ranking (4.83 million € per 1,000 FTE), although in absolute terms it still belongs among the weakest regions. By contrast, Prague, the South Moravian, South Bohemian and Pardubice Regions and Vysočina, while maintaining a relatively high absolute volume of support, show a slight decline in intensity once research capacity is taken into account (relative index below 1).

Table 2: Distribution of financial contribution across Czech regions in H2020 and HE per 1,000 FTE researchers

The current results confirm a dual reality of Czech participation in the FPs: on the one hand, a persistent concentration of support along the metropolitan axis Prague–South Moravian–Central Bohemian, and on the other hand a visible shift in several regions that have managed to grow more rapidly in HE. The key question for the coming years is therefore not “who has grown”, but “how he has grown” – whether the increase is driven by a handful of large projects, or reflects a genuine change in capacities and roles within the regional ecosystem.

To draw more precise conclusions, it will be useful to undertake a detailed analysis of the structure of funded projects and of the activity of organisations in the regions (e.g. intensity of proposal submission, share of coordination roles, etc.).

Author: Daniel Frank, Technology Centre Prague, frank@tc.cz, 18 November 2025

Reproduction and dissemination of this article (blog post), parts thereof, or its attachments in Czech or any other language is permitted only with proper acknowledgement of the source and the author, in line with standard citation practices. Any changes or modifications to the article (beyond purely formal edits) may be made only with the author’s consent. The text has not undergone formal language editing.